As the nation continues to grapple with the effects of the housing crisis, housing counselors stand at the front lines of the recovery effort, both educating consumers and assisting current homeowners in distress. Their work is critical.

A recent foreclosure-prevention study found that counseling not only helps homeowners avoid foreclosure, it’s a key factor in avoiding lapsing back into default. Nearly 70% of the study participants obtained mortgage remedies; 56% were able to become current on their mortgages.

Counseling also helps first-time homebuyers to avoid serious delinquencies. According to the study, counseled homebuyers were more than 30% less likely to be faced with serious delinquencies than those with similar credit profiles did not receive counseling before their home purchase.

Our Approach

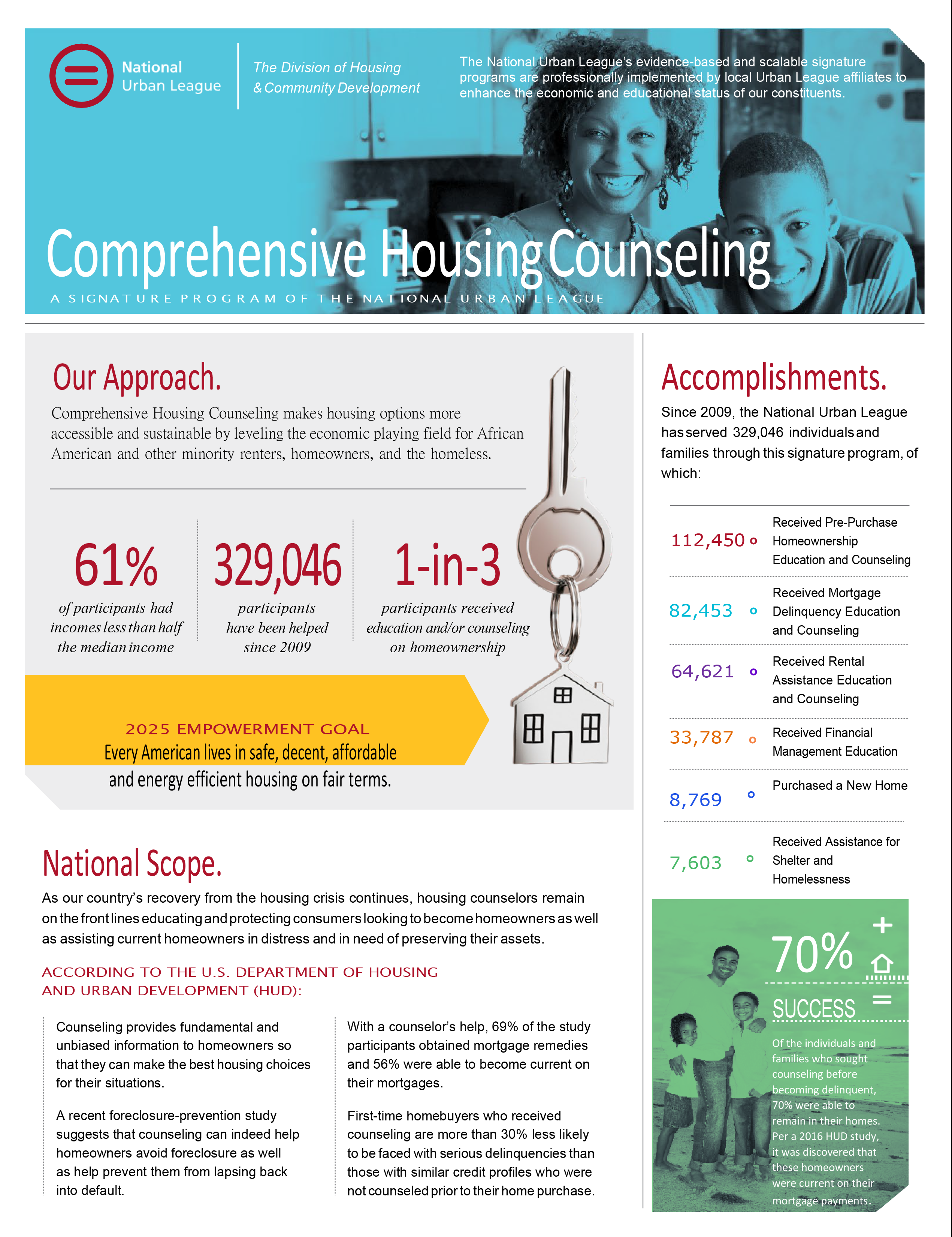

Comprehensive Housing Counseling makes housing options more accessible and sustainable by leveling the economic playing field for African American and other minority renters, homeowners, and the homeless.

2025 Empowerment Goal:

Every American lives in safe, decent, affordable and energy efficient housing on fair terms

Our Services

Counseling services are tailored to meet the needs of each individual, or family, and can address these types of issues:

- Preparation for buying a home

- Default and foreclosure prevention counseling

- Budget and credit counseling

- Home maintenance

- Tenant and landlord rights

- Homelessness

- Reverse mortgage counseling

- Fair housing

Our Impact

of participants had incomes less than half the median income

participants have been helped since 2009

participants received housing counseling and/or education

Accomplishments

Pre-Purchase Homeownership Education

Mortgage Delinquency Education

Rental Assistance Education

Financial Management Education

New Homes

Purchased

Shelter & Homelessness Assistance

Urban League of Greater Atlanta

Chicago Urban League

Urban League of Greater Columbus

Lorain County Urban League

Urban League of Rochester

Urban League of Shenango Valley

Urban League of Broward County

Urban League of Greater Pittsburgh

Greater Sacramento Urban League

Urban League of San Diego County

Urban League of Metropolitan Seattle

Urban League of Metropolitan St. Louis