Giving More Via Stock Donations

Donating appreciated stock is one of the easiest ways to give more to the cause you care about!

Your stock donation is a great way to support our mission, provide an income tax deduction for the full market value

and avoid capital gains tax on the appreciated value.

Donating stock helps reduce your future tax burden and can help you make an impact

on underserved urban communities at less cost.

Today, you can give more with a gift of stock in a just few minutes online.

Access your stock brokerage information by using our secure online stock donation tool.

The easiest way for you to gift stock or securities to the National Urban League is through an electronic transfer (DTC) from your brokerage account to the National Urban League’s account as listed below:

•Receiving Firm Name: Morgan Stanley Smith Barney LLC

•Receiving Account Number: 552133843

•Receiving Firm DTC Number: 0015

•Receiving Account Name: National Urban League

•Tax ID Number: 13-1840489

Please remind your broker(age) to include all the information including your name, contact information and special instructions for the transfer.

Make a Long-Term Impact

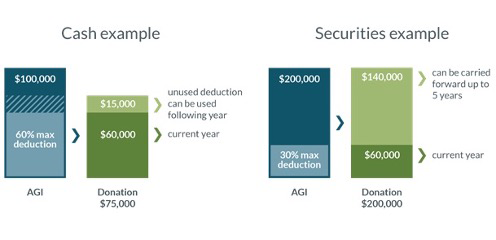

You can make a bigger impact by donating long-term appreciated securities, including stock, bonds, and mutual funds, directly to charity.

Compared with donating cash or selling your appreciated securities and contributing the after-tax proceeds, you may be able to automatically increase your gift and your tax deduction. By donating stock that has appreciated for more than a year, you are actually giving 20 percent more than if you sold the stock and then made a cash donation. The reason is simple: avoiding capital gains taxes.

To be eligible for a charitable deduction for a tax year, donations of stock need to be received by the end of the year. Because different assets take different amounts of time to be transferred, you should initiate your transactions as early as possible.

If you would like to learn more about donating marketable securities, or you would like to donate via wire transfer, please contact

Partnerships & Advancement via: Tspooner-lay@nul.org

Return to Other Ways To Give